This article was originally published by TheStreet on July 24, 2014

NEW YORK (TheStreet) -- Pioneer Natural Resources (PXD_) is eyeing a bright future in oil production growth, but it is an expensive stock.

Pioneer is the biggest player at the Spraberry and Wolfcamp shale rock formations, which are located in the Permian Basin in the western part of Texas. The area is one of the most prolific oil-producing regions in the U.S. The company’s core reserve base could more than double by 2016, while its output, which has been increasing at an accelerated pace, could double by 2018 from its output in 2013.

The company also stands to benefit from a recent Commerce Department ruling that will allow it to export a kind of oil known as condensates. Pioneer is the only company, besides Enterprise Products Partners (EPD_) that received this permission. The U.S. has banned the export of unrefined oil since the 1970s.

Exporting some oil will allow Pioneer to tap into international markets where oil prices carry a premium of up to $20 a barrel over domestic crude prices. The higher prices can give a boost to Pioneer's profits in the future.

Shares of Pioneer, however, are trading close to its 52-week high of $234. Through Wednesday's close, they have risen 27.6% this year, outpacing the S&P 500 Index.

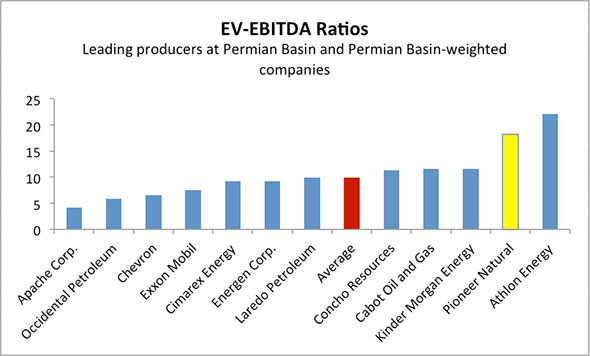

By one measure, the stock is trading at about twice the average of other energy companies operating in the Permian Basin, such as Chevron (CVX_), Cimarex Energy (XEC_), Exxon Mobil (XOM_) and Occidental Petroleum (OXY_).

So investors may want to wait for a pullback before getting into Pioneer.

The Spraberry and Wolfcamp fields have led the revival of Permian Basin. According to the U.S. Energy Information Administration, the daily oil production from Permian Basin has jumped from 850,000 barrels in 2007 to 1.35 million barrels in 2013. This growth was largely driven by an increase in output from six shale-rock formations in general and from Spraberry and Wolfcamp in particular.

With 825,000 acres at the Spraberry and Wolfcamp fields, Pioneer is the largest producer of oil from this region. In April, Pioneer produced 109,000 barrels of oil equivalents per day while its closest peers, Apache (APA_) and Concho Resources (CXO_), produced just 65,000 and 38,000 barrels of oil equivalents per day from Spraberry and Wolfcamp.

Pioneer has 845 million barrels of oil equivalents of proven reserves, of which almost 51%, or 432 million barrels of oil equivalents, is located in Spraberry and Wolfcamp, and it expects to add more than 600 million barrels of oil equivalents to its reserve base at Spraberry and Wolfcamp through 2016.

Last year, the company reported an 11% increase in production overall. It has forecast growth of between 14% and 19% for this year. From 2013 to 2016, Pioneer has said that it will increase its output at an average annual rate of between 16% and 21%. Since the average growth rate is higher than what the company expects to achieve this year, we can safely assume that Pioneer’s production growth rate will get even better in the coming years.

This year, Pioneer will spend $3 billion as drilling capital expenditures, of which more than $2.7 billion will flow toward Spraberry and Wolfcamp. Consequently, the company’s production from those formations is expected to increase by between 21% and 27% this year.

At the time of publication, the author held no positions in any of the stocks mentioned.

This article represents the opinion of a contributor and not necessarily that of TheStreet or its editorial staff.