By Sarfaraz A. Khan and Iffat Zehra

Xiaomi Inc., often dubbed as China's Apple, was originally set up by Lei Jun in 2010 and launched its flagship phone a year later. Besides, Xiaomi also offers other consumer electronic products such as television set-top box called MiBox, a tablet computer called Mi Pad and Android based smart TV.

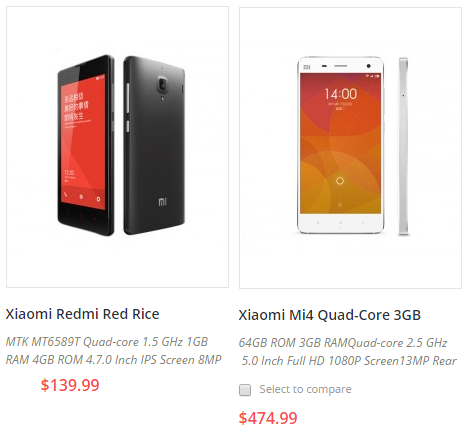

It's the smartphones, however, in which Xiaomi has made its name by offering high-end characteristics, complemented by a low price. The company's most expensive phone, Xiaomi Mi4 Quad-Core with 3GB RAM, is priced at $475 on its website (image below). By comparison, the price of Apple's iPhone 6 starts with $864 in China.

During the third quarter of 2014, Xiaomi went on to become the fourth largest smartphone vendor in the world, behind the industry titans Samsung, Apple and Huawei, according to Gartner's estimates. Furthermore, Xiaomi also overtook Samsung in China to become the biggest player at home. As per some other estimates, the company is already the third largest smartphone maker in the world.

Xiaomi's lowest and highest priced smartphones. (Image source: Xiaomi Mobile Retail Shop)

Xiaomi, however, brands itself as an internet company, rather than a smartphone maker. The company sells its products at lower prices, at razor sharp margins, but in doing so, it drives the consumers towards its software and services business. Xiaomi has been investing in other companies as well as it aims to develop an ecosystem of various internet-connected devices. This software side of the business is what is going to fuel the company's profits.

Since it is selling the hardware near cost, therefore Xiaomi has a significantly less profitable business model than the real Apple. According to the most recent filing from the Chinese appliance maker Midea Group, in which Xiaomi has invested more than $200 million, the former generated revenues of $4.3 billion and operating profits of $78 million in 2013. This translated into operating margin of just 1.8%. Xiaomi generated after-tax profit of $56 million, which reflects as after-tax margin of just 1.3%.

On the other hand, in the last fiscal year, Apple generated revenues of $182.8 billion and operating profits of $52.5 billion. This translated into operating margins of 29% and net profit margin of 22%, well above Xiaomi's.

However, a latest round of fundraising has valued Xiaomi at $45 billion. In these terms, Xiaomi is bigger than some of the other well established names in the internet and technology space such as Sony, and almost as big as Yahoo.

Further, based on data from annual results, Xiaomi is being valued around 58 times its operating profits. That is lofty, considering Apple's current market cap is just 12.3 times its last fiscal year's operating profits.

That said, Xiaomi's business philosophy of selling hardware at razor sharp margins and using this as a distribution channel for growing its more profitable software and services unit is more akin to Amazon. The online retailer has never shied from sacrificing its profits in anticipation of greater market share and future growth. Amazon has been selling its hardware, the Kindle and Fire TV, at cost, just so it can bring more customers to its shopping ecosystem. Consequently, the company's EBIT margin has remained between 1% and 1.8% over the last three fiscal years.

On the flip side, Amazon has grown quickly and has been valued at significantly higher multiples of its earnings, which is similar to Xiaomi.

Over the last ten years, Amazon's annual revenues growth has been more than 22% . On the valuation front, last year, Amazon's shares were priced more than 670 times its earnings and between 73 and 380 times its projected earnings, as per data from Thomson Reuters. The company's current market cap is 192 times its last fiscal year's operating profits.

Xiaomi's growth, on the other hand, has been phenomenal, given that it is still a young company when compared against Amazon. During the third quarter of 2014, Xiaomi's global market share climbed to 5.2% from a meager 1.5% in the third quarter of 2013, Gartner said earlier in December. The Chinese company demonstrated the strongest growth in this period as compared to other five leading smartphone vendors. This is a big deal for a company that was formed just a couple of years ago at a time when Apple launched its iPhone 4 in China. Furthermore, analysts expect Xiaomi to grow its revenues to more than $12 billion in the current year, which shows an increase of 179% in one year.

Bottom-line

Xiaomi is essentially a smartphone maker but it is doing its business like Amazon by selling its hardware at cost and channeling its customers to its more lucrative software operations. It is not surprising therefore that Xiaomi is being valued at $45 billion. In fact, if the Chinese company were priced exactly like Amazon, in terms of last fiscal year's operating profits, then it would have been valued at $150 billion.

Disclosure: Neither Sarfaraz A. Khan, nor Iffat Zehra have any positions in the stock(s) mentioned in this article. The article offers a hypothetical scenario. Xiaomi is a privately held company that does not trade on any stock exchange. The privately held companies may not be valued by private investors in the same way as a publicly traded company which is valued by institutional and retail investors.